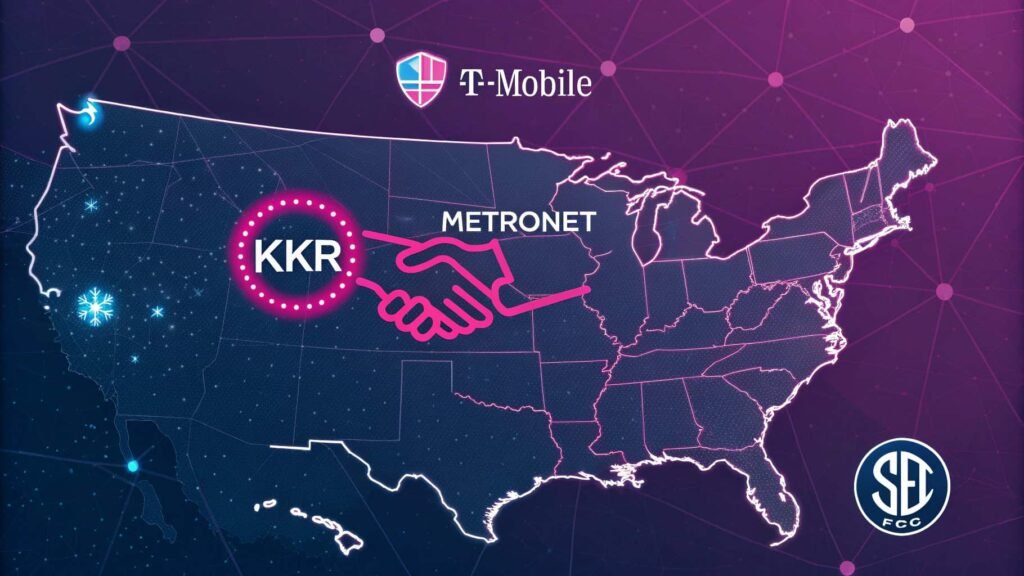

T-Mobile is reportedly planning to acquire Metronet in a $4.9 billion deal to expand fibre internet to millions of homes. The acquisition, expected to close in 2025, will boost T-Mobile’s broadband presence and compete with Verizon Fios and AT&T Fibre.

Stay tuned with us as we delve deeper into the details of T-Mobile reportedly planning to acquire Metronet and what it means for the future of fiber internet.

What is the main news about T-Mobile and Metronet?

T-Mobile is reportedly planning to acquire Metronet through a $4.9 billion joint venture with global investment firm KKR. This major Metronet acquisition includes the company’s entire residential fibre network, which reaches over 2 million homes across 17 states.

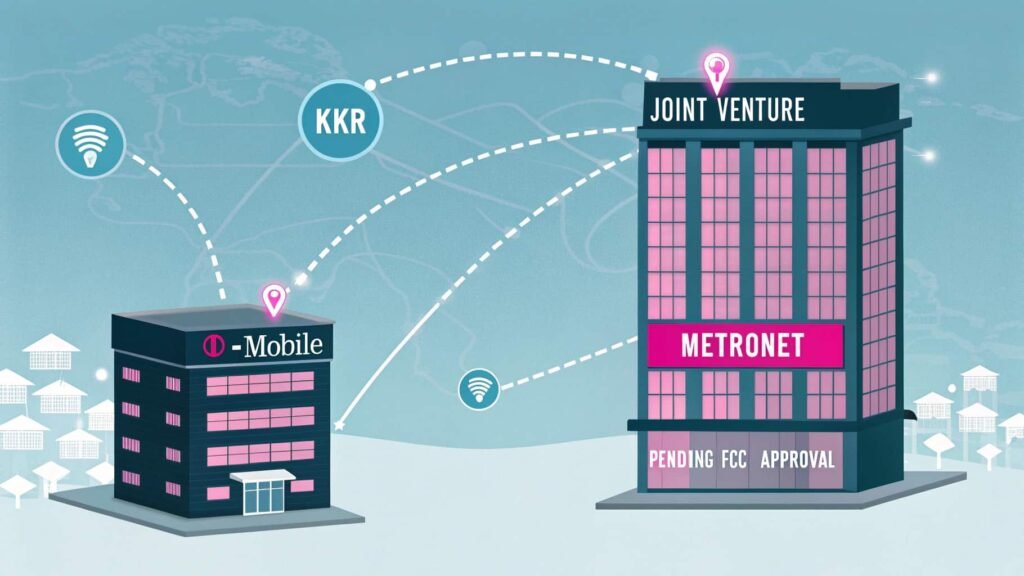

The deal is part of T-Mobile’s acquisition history as it moves deeper into the fibre internet market. Unlike its previous ventures, such as T-Mobile Lumos, this is its most significant move yet in the fixed broadband sector. After the deal closes in 2025 (pending FCC approval), T-Mobile will take over all retail fibre operations, while Metronet will shift to managing network buildouts and infrastructure.

Founded and led by John Cinelli, Metronet will remain a wholesale network provider under this structure. T-Mobile aims to leverage its marketing and retail strengths to expand its customer base and compete with other major ISPs. The plan aligns with T-Mobile’s strategy to reach up to 15 million homes, as seen in the latest Metronet coverage map projections.

As T-Mobile is reportedly planning to acquire Metronet, this move shows its commitment to expanding high-speed fibre access in suburban and rural America, setting up intense competition for legacy cable providers.

How much is T-Mobile investing in this acquisition?

T-Mobile is reportedly planning to acquire Metronet by investing $4.9 billion to secure a 50% equity stake in a joint venture with KKR. This Metronet acquisition cements T‑Mobile’s biggest move in the fibre internet market, building on its T-Mobile acquisition history alongside previous deals like T-Mobile Lumos.

The $4.9 billion investment covers the full scope of Metronet’s residential fibre network, which currently serves approximately 2 million customers. Pending FCC approval, this deal positions T‑Mobile to take over retail fibre operations and drive expansion of its Metronet coverage map to reach 15 million homes potentially.

By investing this substantial amount, T-Mobile is reportedly planning to acquire Metronet, which demonstrates its commitment to compete in the broadband arena and strengthen its role as a national home internet provider.

Who else is involved in the deal?

T-Mobile is reportedly planning to acquire Metronet through a strategic partnership that extends beyond just T-Mobile and Metronet. The joint venture includes KKR, a leading global investment firm, which will partner equally on the Metronet acquisition.

Additionally, Oak Hill Capital, a current backer of Metronet, plans to reinvest and retain a minority stake in the company. John Cinelli, who founded Metronet, will also continue in his leadership role and hold a minority position after the deal closes.

This collaboration aligns with T‑Mobile’s acquisition history, reflecting a consistent pattern of teaming up with strong partners, similar to its previous T‑Mobile Lumos venture. With FCC approval expected in 2025, the combined ownership structure ensures continuity and expertise across both investment and operations.

As T-Mobile is reportedly planning to acquire Metronet, the deal rests on a strong foundation, with KKR, Oak Hill Capital, and John Cinelli actively involved in shaping its next phase.

What will happen to Metronet after the acquisition?

Once T-Mobile is reportedly planning to acquire Metronet and the deal closes (expected in 2025, pending FCC approval), Metronet will change its market role. Instead of handling retail customers directly, Metronet will focus on being a wholesale network provider, managing network construction, engineering, and deployment.

At the same time, T-Mobile will take over all residential fibre retail operations, including customer service and marketing. This means T-Mobile will directly serve the customers currently using Metronet’s fibre internet.

This transition reflects T-Mobile’s broader strategy, consistent with its acquisition history and similar to its work with T-Mobile Lumos. With John Cinelli still involved, Metronet’s infrastructure and growth plans will support T-Mobile’s goal of expanding fibre access across its growing Metronet coverage map.

In short, after the acquisition, Metronet becomes the backbone provider while T-Mobile leads retail broadband services to more homes nationwide.

What does Metronet currently offer?

T-Mobile is reportedly planning to acquire Metronet, a leading fibre-to-the-home (FTTH) Internet Service Provider (ISP) in the U.S. Metronet delivers 100% fibre internet with symmetrical speeds and no data caps, providing a reliable and fast online experience.

Internet Plans

Metronet offers a range of internet plans to suit various needs:

- 150 Mbps: Ideal for light browsing and streaming.

- 500 Mbps: Suitable for moderate usage, including HD streaming and gaming.

- 1 Gbps: Ideal for high-demand applications, including 4K streaming and large file transfers.

- 2 Gbps: Designed for high-demand households with multiple users.

- 5 Gbps: Metronet’s fastest plan, available in select markets for extreme usage scenarios.

All plans include an eero wireless router for enhanced Wi-Fi coverage and performance.

Pricing and Promotions

Metronet’s pricing starts at $34.95 per month for the 150 Mbps plan. They frequently offer promotions, including gift cards and discounted Whole Home WiFi services, to provide added value to their customers.

Service Areas

Metronet’s services are available in 17 U.S. states, primarily in the Midwest and South regions. Their expansion plans aim to reach 6.5 million homes by 2030, enhancing their Metronet coverage map.

Additional Services

Beyond the internet, Metronet offers phone services starting at $15 per month, providing customers with unlimited calling options.

What is T-Mobile’s goal with this acquisition?

T-Mobile is reportedly planning to acquire Metronet as part of its strategy to expand beyond wireless services and become a significant player in the U.S. broadband market. The acquisition aims to:

- Expand Fibre Reach: By integrating Metronet’s existing infrastructure, T-Mobile plans to extend its fibre network to approximately 6.5 million homes by 2030.

- Enhance Service Offerings: The acquisition enables T-Mobile to offer symmetrical fibre internet services, providing customers with faster and more reliable internet connections.

- Leverage Existing Infrastructure: Utilising Metronet’s established network enables T-Mobile to expand its broadband services without incurring significant additional capital expenditures.

- Complement Wireless Services: The acquisition complements T-Mobile’s existing 5G Home Internet service, enabling the company to offer a comprehensive suite of broadband solutions to customers.

In summary, T-Mobile is reportedly planning to acquire Metronet to accelerate its growth in the broadband sector, enhance its service offerings, and leverage its existing infrastructure to expand its fibre network efficiently.

Will Metronet become an open-access network?

No, Metronet will not become an open-access network following its acquisition by T-Mobile and KKR. An open-access network is a model where the infrastructure owner provides access to multiple service providers, allowing consumers to choose from various ISPs. In this case, Metronet will transition to a wholesale service provider model, focusing on network construction and maintenance. At the same time, T-Mobile will assume responsibility for all residential customer-facing operations, including acquisition and support.

This approach differs from KKR’s previous investments in open-access networks in other countries, such as in Chile, Colombia, Peru, and the Netherlands. However, the Metronet deal is structured to integrate services under T-Mobile’s brand, rather than offering multiple ISPs access to the same infrastructure.

Therefore, Metronet will not become an open-access network; instead, it will operate as a wholesale provider supporting T-Mobile’s retail broadband services.

Will existing Metronet customers see changes?

Yes, existing Metronet customers can expect significant changes following the acquisition by T-Mobile and KKR, which is anticipated to close in 2025.

Transition of Services

Upon completion of the acquisition, Metronet will cease its direct residential customer operations. All residential fiber retail services and customer accounts will be transferred to T-Mobile. T-Mobile will assume full responsibility for customer acquisition, billing, support, and service management, leveraging its established retail and customer service infrastructure.

Impact on Existing Contracts

Customers should not experience immediate disruptions. The acquisition is structured to ensure continuity of service. Existing contracts and service agreements are expected to be honored, and T-Mobile has assured that there will be no termination of current services.

Potential Service Enhancements

With T-Mobile’s involvement, customers may benefit from enhanced service offerings, including improved customer support, streamlined billing processes, and potential bundling options with T-Mobile’s wireless services. Additionally, T-Mobile’s extensive marketing and retail capabilities could lead to expanded service availability in more regions.

Concerns and Customer Sentiment

Some customers have expressed concerns about potential price increases and changes in service quality following the acquisition. While T-Mobile has not announced any immediate changes to pricing, customers should stay informed about any future updates or modifications to their service plans.

What states does Metronet operate in?

Metronet operates in 17 states across the United States, providing 100% fiber-optic internet services to residential and business customers. The company is actively expanding its network and currently serves approximately 3.1 million residents. By the end of 2030, Metronet aims to reach 6.5 million homes and businesses.

Metronet’s services are available in the following states:

- Arizona

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kentucky

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- North Carolina

- Ohio

- Texas

- Virginia

- Wisconsin

To check if Metronet services are available in your area, visit their official website and enter your ZIP code.

This expansion aligns with T-Mobile’s strategy to diversify its offerings beyond wireless services and enhance its broadband footprint. By acquiring a 50% stake in Metronet through a joint venture with KKR, T-Mobile aims to leverage Metronet’s existing infrastructure to accelerate its entry into the fiber-optic internet market.

How does this move compare with Verizon Fios or AT&T Fiber?

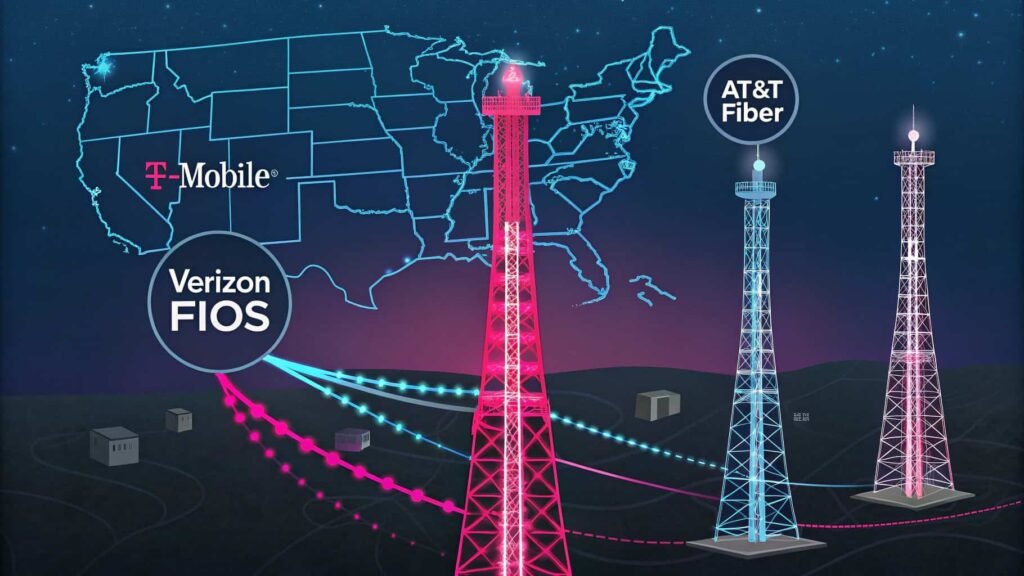

T-Mobile is reportedly planning to acquire Metronet to expand its fiber internet presence, directly competing with established providers such as Verizon Fios and AT&T Fiber.

Here’s how the acquisition stacks up:

- Network Reach: Verizon Fios and AT&T Fiber have established long-standing fiber networks, covering millions of homes across numerous states. Metronet currently serves around 2 million customers in 17 states, with plans to expand to 6.5 million homes by 2030. This acquisition allows T-Mobile to quickly enter the fiber market by leveraging Metronet’s existing infrastructure rather than building from scratch.

- Business Model: Verizon and AT&T operate both wireless and fiber services, offering bundled packages. T-Mobile’s purchase of Metronet fits its strategy to provide combined wireless and fiber broadband bundles, matching the services of these competitors.

- Growth Strategy: While Verizon and AT&T have primarily grown their fiber networks organically or through smaller acquisitions, T-Mobile’s approach relies on strategic partnerships, such as those with KKR, as well as companies like Metronet and Lumos, to accelerate fiber rollout.

- Customer Impact: Verizon and AT&T have mature customer support and wide availability. T-Mobile’s acquisition promises to leverage its strong marketing and customer service skills to enhance Metronet’s offerings, potentially improving the consumer experience.

In summary, T-Mobile is reportedly planning to acquire Metronet as a means to quickly challenge Verizon Fios and AT&T Fiber, aiming to become a top-tier fiber broadband provider with a nationwide footprint and bundled service options.

Is this T-Mobile’s first fiber deal?

No, T-Mobile is reportedly planning to acquire Metronet as part of its broader strategy to expand into the fiber broadband market. This acquisition follows T-Mobile’s earlier move into fiber through a joint venture with EQT to acquire Lumos, a fiber-to-the-home provider. The Lumos deal was finalized on April 1, 2025, marking T-Mobile’s initial entry into the fiber space.

With the Metronet acquisition, T-Mobile aims to expand its fiber footprint further, targeting up to 15 million homes by 2030. This move positions T-Mobile to compete more directly with established fiber providers, such as Verizon Fios and AT&T Fiber.

In summary, while Metronet represents T-Mobile’s second major fiber acquisition, it underscores the company’s commitment to becoming a significant player in the fiber broadband market.

Will T-Mobile need to invest more money after the deal?

No, T-Mobile does not anticipate making additional capital contributions beyond the initial $4.9 billion investment for the Metronet acquisition. According to a filing with the U.S. Securities and Exchange Commission, the joint venture is expected to be self-funding on a go-forward basis. T-Mobile has stated that it does not plan to provide any further capital to the venture to support its business plan, which aims to reach approximately 6.5 million homes passed by the end of 2030.

This capital-efficient approach allows T-Mobile to expand its fiber broadband services without significant additional investment, leveraging Metronet’s existing infrastructure and operational expertise. The joint venture structure, with T-Mobile and KKR each holding a 50% stake, enables shared financial responsibility and risk mitigation.

In summary, T-Mobile’s Metronet acquisition is designed to be financially sustainable without requiring additional capital contributions, aligning with the company’s strategy to efficiently expand its broadband footprint.

FAQ’s

1. Does T-Mobile own Metronet?

Not yet. T-Mobile is planning to acquire Metronet, with the deal expected to close in 2025.

2. Is Metronet being acquired?

Yes, T-Mobile and KKR are acquiring Metronet in a $4.9 billion joint venture.

3. Who is Metronet’s parent company?

Currently, Oak Hill Capital and John Cinelli own Metronet. They will keep minority stakes after the deal.

4. Is Metronet closing?

No. Metronet will continue operating and become a wholesale network provider after the acquisition.

Conclusion

T-Mobile is reportedly planning to acquire Metronet, marking a significant milestone in its journey to become a leading fiber broadband provider in the U.S. This strategic acquisition not only expands T-Mobile’s fiber network reach but also strengthens its position against competitors like Verizon Fios and AT&T Fiber. By partnering with KKR and leveraging Metronet’s robust infrastructure, T-Mobile aims to deliver faster, more reliable internet to millions of homes nationwide.

As T-Mobile continues to diversify beyond wireless services, this deal reflects its commitment to innovation and growth in the broadband market. Customers and investors alike will be watching closely as T-Mobile’s acquisition of Metronet reshapes the fiber internet landscape, promising enhanced connectivity and competitive choices for consumers across many states.

Also read:

- 2025 Guide to Mobile Home Mortgage Rates Explained!

- Easy Mobile Home Removal: Affordable Local Solutions 2025!

- Used Mobile Home Value Price Guide Free:2025 Update!