Mobile home mortgage rates in 2025 typically range from 6.75% to 10.5%, depending on credit score, loan type, and whether land is included. Homes on owned land with permanent foundations usually qualify for lower rates. Comparing lenders and improving your credit can help you secure the best rate.

Stay tuned with us — we’ll keep bringing you the latest insights, updates, and expert tips on mobile home mortgage rates to help you make smart, money-saving decisions.

Introduction to Mobile Home Mortgage Rates

If you’re looking to buy a mobile home, one of the first things you’ll need to understand is mobile home mortgage rates. These are the interest rates you’ll pay when you borrow money to buy a mobile home. Just like regular home loans, these rates decide how much you’ll pay each month and over time.

But mobile home mortgage rates are not always the same as rates for traditional homes. In many cases, they’re a bit higher. That’s because mobile homes are sometimes seen as more risky by lenders, especially if the house is older or if it’s not set on permanent land. Rates can also change based on the type of loan you obtain, your credit score, and the location of the home.

For example, a new mobile home on its land may get better rates than a used one in a rented park. That’s why it’s important to compare options and know what affects your mobile home mortgage rates before choosing a loan.

This guide will help you understand what these rates mean, how they work, and what you can do to find the best rate for your home. Whether you’re buying your first mobile home or thinking about refinancing, learning about mobile home mortgage rates can help you save money and avoid surprises.

Factors That Influence Mobile Home Mortgage Rates

Several things can change your mobile home mortgage rates. Knowing these can help you plan more effectively and reduce your costs. Here are the main factors:

Credit Score

Your credit score matters a lot. A high score shows lenders you’re reliable. If your score is low, your mobile home mortgage rates will likely be higher. A strong score can lead to better offers and lower monthly payments.

Type of Loan

There are different kinds of loans. If you choose a chattel loan (for homes without land), the interest is usually higher. If the mobile home is on land you own, you may be eligible for a traditional mortgage with more favourable mobile home mortgage rates.

New vs. Used Mobile Home

New mobile homes often qualify for lower rates. Lenders see them as less risky. Used mobile homes may come with higher mobile home mortgage rates due to their age, condition, and lower resale value.

Down Payment

A bigger down payment means you borrow less. This can help reduce your mobile home mortgage rates. Putting down more money shows lenders you’re serious and lowers their risk.

Loan Term

Shorter loan terms usually come with lower rates. If you choose a 15-year loan instead of 30 loan, your monthly payments may be higher, but you’ll pay less interest over time.

Location

Where the home is located matters; for example, manufactured home loan rates in California may differ from those in other states. Local laws, property values, and demand all play a part.

Home Placement

If your home is on a permanent foundation, it can qualify as real property. That often means lower mobile home mortgage rates. Homes in parks or rented lots typically fall under personal property loans, which often have higher interest rates.

Factors That Influence Mobile Home Mortgage Rates

Several things can change your mobile home mortgage rates. Knowing these can help you plan more effectively and reduce your costs. Here are the main factors:

Credit Score

Your credit score matters a lot. A high score demonstrates to lenders that you’re reliable. If your score is low, your mobile home mortgage rates will likely be higher. A strong score can lead to better offers and lower monthly payments.

Type of Loan

There are different kinds of loans. If you choose a chattel loan (for homes without land), the interest is usually higher. If the mobile home is on land you own, you may be eligible for a traditional mortgage with more favourable mobile home mortgage rates.

New vs. Used Mobile Home

New mobile homes often qualify for lower rates. Lenders see them as less risky. Used mobile homes may come with higher mobile home mortgage rates due to their age, condition, and lower resale value.

Down Payment

A bigger down payment means you borrow less. This can help reduce your mobile home mortgage rates. Putting down more money shows lenders you’re serious and lowers their risk.

Loan Term

Shorter loan terms usually come with lower rates. If you choose a 15-year loan instead of 30 loan, your monthly payments may be higher, but you’ll pay less interest over time.

Location

Where the home is located matters; for example, manufactured home loan rates in California may differ from those in other states. Local laws, property values, and demand all play a part.

Home Placement

If your home is on a permanent foundation, it can qualify as real property. That often means lower mobile home mortgage rates. Homes in parks or rented lots typically fall under personal property loans, which usually have higher interest rates.

Current Mobile Home Mortgage Rate Ranges (2025)

As of mid‑2025, mobile home mortgage rates vary based on loan type, loan term, and home setup. Here’s a snapshot of the main ranges:

Traditional Manufactured‑Home Mortgages (Real Property)

- 30‑year fixed: Around 6.75% – 6.90% interest

- 15‑year fixed: Near 6.13% – 6.33% interest These rates apply when the mobile home is on land you own and set on a permanent foundation.

Chattel Loans (Personal Property)

- Interest typically 8% or higher

- Range often spans 5.5% – 12.99%, depending on credit, location, and loan terms

- Terms are usually shorter (10–20 years)

Credit Union & Specialized Lenders

- Some credit unions offer fixed rates around 9.6% – 10.2% for 10‑ to 30‑year loans

- These often require 25% down and good credit scores (e.g., 780 FICO)

Market Outlook

- Overall mortgage environment remains elevated, with mainstream 30‑year mortgage rates around 6.3% – 6.9%

- Mobile home mortgage rates usually stay higher than standard home loans due to increased risk and lower resale values.

What This Means for You

- If your mobile home is permanently placed on owned land (real property), expect mid‑6% rates.

- If you’re financing a standalone mobile home on rented land (chattel loan), prepare for 8–12 %+ interest.

- Credit unions or specialised lenders may offer mid‑to‑high single-digit rates, often with stricter terms or higher credit requirements.

Chattel Loans vs. Real Property Mortgages

When financing a mobile home, you typically have two options: a chattel loan or a real property mortgage. These two options affect your mobile home mortgage rates, loan terms, and monthly costs.

Chattel Loans

A chattel loan is used when the mobile home is considered personal property. This occurs when the house is situated on rented land, such as in a mobile home park, or when it lacks a permanent foundation.

- Higher mobile home mortgage rates (often 7%–12% or more)

- Shorter loan terms (10 to 20 years)

- Easier to qualify, but often more expensive

- You don’t need to own the land.

These loans are standard for used mobile homes or when the buyer can’t buy land with the house.

Real Property Mortgages

If the mobile home is installed on land you own and has a permanent foundation, it may be treated like a traditional home. This qualifies it for a real property mortgage.

- Lower mobile home mortgage rates (often similar to standard home loans)

- Longer loan terms (up to 30 years)

- More protections for buyers

- Eligible for FHA, VA, USDA, or conventional loans

Real property loans give you access to better programs and lower monthly payments, especially over time.

Which One is Better?

If you own the land and want long-term savings, a real property mortgage is often the better choice. If you’re buying a home in a park or need faster financing, a chattel loan may be right for you, but expect higher mobile home mortgage rates.

Top Lenders & Loan Programs

When shopping for the best mobile home mortgage rates, knowing the top lenders and loan programs can help you make a wise choice. Each lender offers different terms, rates, and requirements based on your home type and financial profile. Let’s look at the leading options in 2025:

21st Mortgage Mobile Home Rates

21st Mortgage is one of the most well-known lenders for mobile homes, particularly for those located in parks or on rented land. They focus heavily on chattel loans, which usually come with higher mobile home mortgage rates.

- Rates typically range from 7% to 14%, depending on credit and loan term.

- Offers financing for used mobile homes, even with lower credit scores

- No land ownership required

- Loan terms from 5 to 30 years

This lender is a good option if you’re buying a used home or need financing without owning land.

Freddie Mac & Fannie Mae MH Advantage

Both Freddie Mac and Fannie Mae offer special programs for manufactured homes, called MH Advantage and CHOICEHome, respectively. These are ideal for buyers who own their land or plan to buy it along with the house.

- Lower mobile home mortgage rates, similar to site-built homes

- Fixed-rate loans up to 30 years

- Requires a permanent foundation and homes that meet HUD code

- Must look like a traditional house (e.g., pitched roof, porch, energy-efficient features)

These programs are best if you want traditional home financing and long-term savings.

FHA / VA / USDA Options

Government-backed loans help buyers get better terms and lower mobile home mortgage rates.

FHA Loans

- Available for homes on permanent foundations

- Credit scores as low as 500–580 accepted

- Offers longer terms and smaller down payments

- Good for first-time buyers

VA Loans (for eligible veterans)

- No down payment required

- Competitive rates and no private mortgage insurance (PMI)

- Must meet specific home and foundation standards

USDA Loans

- For rural properties only

- No down payment

- Low interest rates

- Income and location rules apply.

These programs can offer some of the best mobile home mortgage rates when the home meets the proper guidelines.

Used Mobile Home Mortgage Rates Explained

Buying a used mobile home can save money upfront, but it may come with higher interest rates on mobile home mortgages. Lenders perceive more risk with older homes, which often results in higher interest rates and fewer loan options.

Why Are Rates Higher for Used Homes?

- Age of the home: Older homes may not meet current building or safety codes

- Condition: Wear and tear affects resale value, making lenders cautious

- Loan type: Most loans for used homes are chattel loans, which have higher mobile home mortgage rates

Typical Rates in 2025

- Chattel loans for used mobile homes often range from 8% to 14%

- Rates depend on credit, home condition, and whether land is included.

- If the home is set on owned land with a permanent foundation, real property loans may be available with rates as low as 6.75%

How to Get a Better Rate

- Choose a home that meets HUD standards and is in good condition.

- Try to buy land with the home, if possible.

- Make a larger down payment to reduce loan risk.

- Improve your credit score before applying.

- Use a used mobile home interest rate calculator to compare lenders.

If you’re buying a used mobile home, be ready for slightly higher rates, but don’t settle. Compare options, check lender programs like 21st Mortgage, and determine if you qualify for FHA or credit union loans that offer more favourable terms.

How to Use a Mobile Home Interest Rate Calculator

A mobile home interest rate calculator is a simple tool that helps you estimate your monthly payments based on the loan amount, rate, and term. It’s one of the best ways to understand how different mobile home mortgage rates will affect your budget before you apply for a loan.

Step-by-Step Guide

1. Enter the Loan Amount

Start by typing in how much you plan to borrow. This could be the full price of the mobile home or the price minus your down payment.

2. Input the Interest Rate

Next, enter the estimated mobile home mortgage rate. If you’re using a chattel loan, the rate might be between 8% to 14%. For a real property mortgage, you might enter a rate of 6.75%.

3. Choose the Loan Term

Decide how long you want to take to pay off the loan. Standard terms are 15, 20, or 30 years. A longer term means lower monthly payments, but more interest paid over time.

4. View the Results

The calculator will show you:

- Monthly payment (principal + interest)

- Total interest paid

- Total repayment amount

Example

Let’s say:

- Loan Amount: $80,000

- Interest Rate: 9.5% (standard for used homes)

- Term: 20 years

The calculator might show:

- Monthly Payment: $749

- Total Interest: $59,800

- Total Cost: $139,800

Why This Matters

Using a mobile home interest rate calculator helps you:

- Compare different mobile home mortgage rates

- See how your credit score or down payment affects payments.

- Choose the loan term that fits your budget.

- Avoid surprises when talking to lender.s

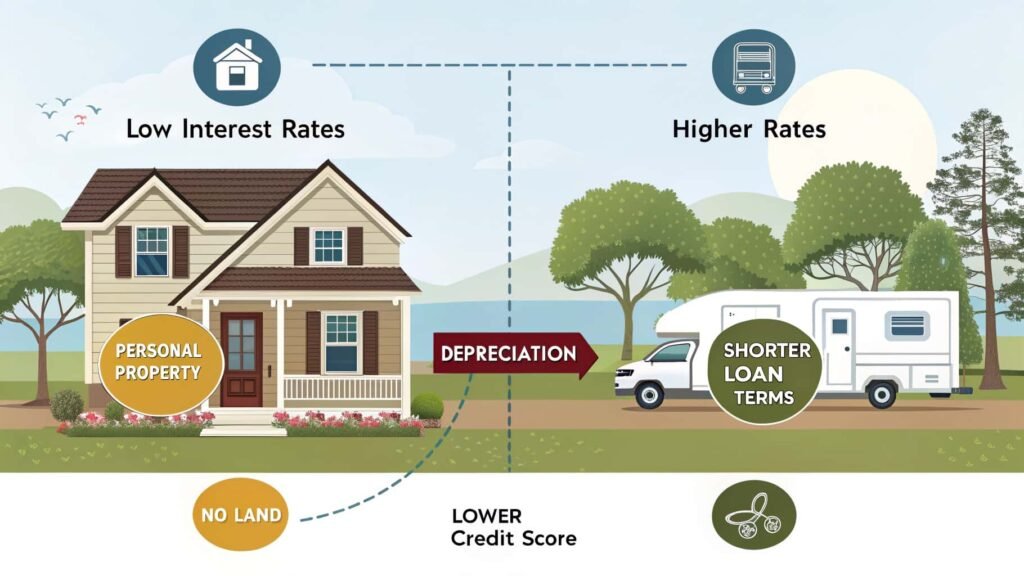

Why Are Mobile Home Interest Rates So High?

Many people wonder why mobile home mortgage rates are higher than those for traditional home loans. The reason comes down to risk, loan type, and how mobile homes are classified.

Mobile Homes Often Count as Personal Property

Most mobile homes, especially those placed in a park or on rented land, are not considered real estate. They are seen as personal property, like a car. Loans for personal property—called chattel loans—typically come with higher interest rates because lenders face a greater risk.

Depreciation

Unlike regular houses, mobile homes can lose value over time. This makes them less secure for lenders. A home that drops in value means the lender might not recover the full loan amount if the borrower defaults.

Shorter Loan Terms

Chattel loans are often shorter, 10 to 20 years instead of 30. Shorter terms mean higher monthly payments, and they usually come with higher mobile home mortgage rates to match the risk.

No Land Included

If you don’t own the land under your home, the loan becomes riskier for the bank. Land adds value and stability to a home loan. Without it, the home is easier to move or abandon, so lenders increase the rate.

Lower Credit Profiles

Mobile home buyers sometimes have lower credit scores or smaller down payments. This leads lenders to offer higher mobile home mortgage rates to balance the risk.

Manufactured Home Loan Rates in California

If you’re looking for mobile home mortgage rates in California, you’ll find options tailored to both chattel loans and traditional mortgages. Here’s what matters in 2025:

Current Rate Overview

- Manufactured home loan rates in California start around 6.75% for permanent foundations and land ownership, similar to national averages

- Credit unions, like Holy Rosary CU, offer 9.74% (15-year) to 10.24% (30-year) rates for homes set up as personal property.

- Some banks (e.g., First Fed in Washington, but relevant elsewhere) quote rates like 6.75% (30 yr) and 6.125% (15 yr) with 25% down and strong credit.

Key Factors in California

- Foundation & Classification – Permanent foundation and real property status open lower mobile home mortgage rates (around 6.75%).

- Loan Type & Term – Chattel loans (without land) typically start in the 9–10% range for 15–30-year terms.

- Loan-to-Value & Credit – Strong credit (780+ FICO) and high down payments (25%) help secure the best rates.

- Competitive Local Lenders – California-focused lenders offer 95% financing on mobile homes, with flexible terms ranging from 5 to 30 years, although exact rates can vary. For more information, visit.

How to Get a Better Rate in California

- Choose a permanent foundation and qualify as real property to access lower rates.

- Improve your credit score and put down at least 20–25%.

- Compare both chattel and permanent-mortgage lenders in the state.

- Consider local programs (like CalHFA) for down payment or rate assistance

With the proper setup—owning land, a permanent foundation, and strong finances—you can find mobile home mortgage rates in California that are close to traditional home loans (~6.75%). Without land, expect higher rates (often 9–10% or more).

Tips to Find the Best Mobile Home Mortgage Rates

Getting the best mobile home mortgage rates can save you thousands over the life of your loan. Here are simple tips to help you find the lowest rates and best terms:

Improve Your Credit Score

Lenders reward good credit. Aim for a score above 700 to qualify for the lowest mobile home mortgage rates.

Make a Bigger Down Payment

Putting down 20% or more reduces your loan amount and shows lenders that you’re a lower risk. This often results in better rates.

Choose a Real Property Loan

Place your mobile home on land you own with a permanent foundation. Loans classified as real property usually have lower mobile home mortgage rates than chattel loans.

Shop Around and Compare Lenders

Different lenders offer different rates. Check with banks, credit unions, specialised lenders like 21st Mortgage, and government programs.

Consider the Loan Term Carefully

Shorter loan terms (15 or 20 years) often have lower rates but higher monthly payments. Longer terms reduce monthly costs but may come with slightly higher rates.

Use a Mobile Home Interest Rate Calculator

Try different rates, loan amounts, and terms to see what fits your budget before applying.

Look Into Government-Backed Loans

Programs like FHA, VA, and USDA can offer lower mobile home mortgage rates and easier qualifying requirements.

By following these tips, you can find competitive mobile home mortgage rates that fit your budget and help you own your home comfortably.

FAQ’s

1. What are the current interest rates for mobile homes?

As of mid-2025, mobile home mortgage rates start around 6.75% for homes on permanent foundations with land ownership. Rates for homes classified as personal property (chattel loans) are typically higher, ranging from 9% to 10.5%, depending on credit and loan terms.

2. Are mortgage rates higher for mobile homes?

Yes, mobile home mortgage rates are generally higher than those for traditional site-built homes. This is due to factors like depreciation, shorter loan terms, and the classification of many mobile homes as personal property, which carries more risk for lenders.

3. What is the average loan term for a mobile home?

Loan terms for mobile homes typically range from 15 to 30 years. Real property mortgages (for homes on owned land with a permanent foundation) often offer longer terms, while chattel loans (for homes on rented land or without a permanent foundation) usually have shorter terms.

4. Can you get a regular mortgage for a mobile home?

Yes, you can obtain a regular mortgage for a mobile home if it meets specific criteria:

- Permanent Foundation: The home must be affixed to a permanent foundation.

- Real Property Classification: The home must be classified as real estate, not personal property.

- Land Ownership: You must own the land on which the home is situated.

Programs like Fannie Mae’s MH Advantage and Freddie Mac’s CHOICE Home offer conventional financing for qualifying manufactured homes.

Conclusion

Understanding mobile home mortgage rates is crucial for making informed decisions when buying or refinancing a mobile home. Rates vary depending on loan type, home condition, credit score, and whether you own the land. Generally, loans for homes on permanent foundations and land owned outright offer lower rates, while chattel loans tend to have higher rates due to the greater risk associated with them.

To secure the best mobile home mortgage rates, focus on improving your credit, saving for a larger down payment, and exploring government-backed loan programs, such as FHA, VA, or USDA. Use tools like a mobile home interest rate calculator to compare offers and find monthly payments that fit your budget.

Also read:

- Easy Mobile Home Removal: Affordable Local Solutions 2025!

- The Sensation Mobile Home: Affordable & Modern Living!

- Underpinning Mobile Home Ideas That Save Money!